Telco enterprise sales has never been “just sales.” It is a high-stakes exercise in translating messy, half-spoken customer intent into something your organization can actually deliver and bill correctly. A call with a prospect is only the beginning. The real work is what happens after: qualifying the deal, shaping the right package, validating it against the catalog, sizing it credibly, checking for compatibility rules, and updating CRM fields that drive forecasting. Separately, there is a second, constant challenge: coaching consistent rep execution at scale, against the operator’s playbook.

This is where many AI initiatives quietly stall. Organizations invest in revenue intelligence platforms and conversation intelligence agents expecting a step change in execution. They get better transcripts, cleaner summaries, and some coaching insights. Useful, but rarely transformative. The hard part of telco selling is not remembering what was said. The hard part is turning what was said into structured, telco-aware actions across CRM and product systems, fast enough to affect the deal while it is still alive.

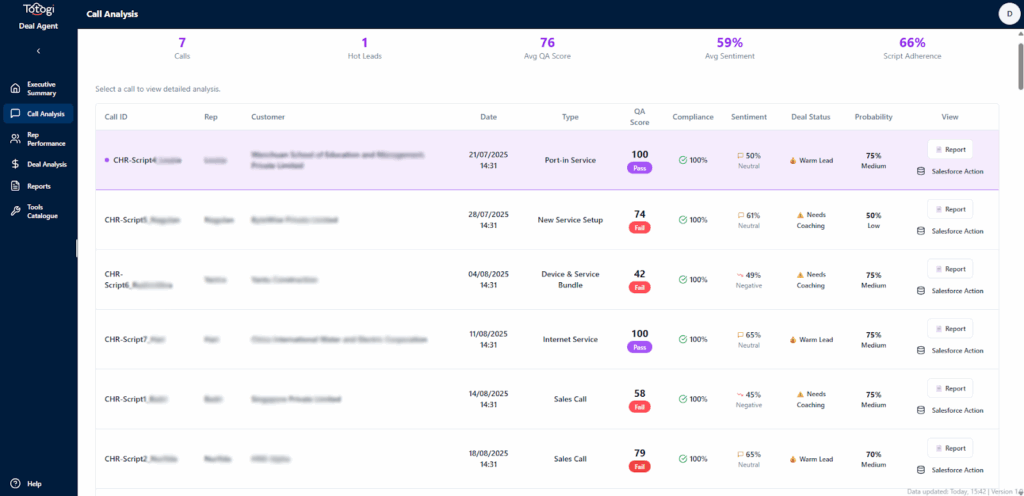

In a recent customer project, we built exactly that: an ontology-powered, telco-specific deal intelligence overlay that listens to sales calls and interprets them, pulls customer history from Salesforce, reads product and pricing reality from telco CPQ and catalog systems, and then recommends the next best package while updating lead and opportunity records automatically. In parallel, it gives managers consistent, evidence-based coaching signals by scoring call execution against the operator’s playbook. It is not another dashboard. It is an execution layer for enterprise sales. The best part: thanks to the telco ontology that acts as the semantic layer and normalizes entities and relationships across the different systems, BSS Magic and a single Forward Deployed Engineer (FDE) delivered this solution in just four weeks, from concept to deployment.

Why horizontal revenue intelligence platforms hit a ceiling in telco

Platforms like Gong and Clari have earned their place in mainstream B2B sales. They bring discipline to pipeline hygiene, improve coaching coverage, and help teams communicate forecast risk. In many industries, that is enough because what you sell is relatively straightforward: a product, a service tier, a contract, a renewal.

Telco enterprise deals are different. A customer might ask for “a broadband renewal” on a call, but what you actually need to determine is whether they qualify for a higher speed tier, whether a promotional price can be offered without breaking margin rules, whether the current bundle is compatible with service constraints, and what the optimal upgrade path looks like given their footprint and usage history.

Horizontal revenue intelligence platforms, designed for cross-industry B2B sales, typically stop at recognition and summarization. They can detect that “pricing” and “renewal” were discussed. They can flag a risk phrase like “no budget.” They can produce an impressive recap. But they do not have the telco context required to map the conversation into the operator’s product constructs, pricing rules, eligibility constraints, and downstream feasibility. Without that, you still have a human doing the most expensive work: interpreting the call, hunting through the catalog, checking customer history, building a package, updating Salesforce, and then trying to keep the deal aligned through quoting and ordering.

Telco enterprise sales needs a level of tailoring that most horizontal SaaS platforms are not designed to deliver. The operator’s playbook is only half the story. The other half is the operator’s product semantics, CPQ and catalog structures, customer hierarchies, and the downstream reality of quote to order and billing. Horizontal platforms can be configured, but they are not built to become fluent in that operational context, and that is where telco deals are won or lost.

The real pain: call intelligence that does not change outcomes

The customer we worked with was not trying to build a better transcript repository. They were trying to fix the economics and execution quality of enterprise sales.

Management could not realistically listen to enough calls to coach consistently. QA checks were uneven because sampling is inherently uneven. Reps were spending time on administrative tasks that should have been automated. Forecast accuracy suffered because opportunity records were incomplete or inconsistent, especially early in the deal when leaders need clarity most.

They wanted something very specific: a system that can listen to calls at scale, coach reps against the operator’s playbook, and convert deal insights into next steps that appear inside the systems the sales organization already runs on.

What we built: telco deal intelligence that connects calls to CRM, CPQ and the catalog

The solution combined three streams of context and made them usable together: what was said on the call, what is true about the customer in CRM, and what is actually sellable in the catalog and CPQ.

First, calls were captured from Webex and converted into transcripts, with analysis of sentiment shifts and moments that matter. This is not fluff. In enterprise telco sales, tone changes often correspond to qualification gates: hesitation around price, uncertainty about timeline, a requirement that is not negotiable, or a hidden constraint that reshapes the deal.

Second, the system applied the operator’s own training and QA criteria to every call automatically. Instead of listening to a handful of calls per rep each month, the platform assessed calls consistently against the same categories the business already uses: opening and closing quality, verification questions, product knowledge, communication effectiveness, and other playbook-driven behaviors. The key point is that these scoring metrics were not generic. They were derived from the operator’s own documentation and QA standards.

Third, and most importantly, the platform moved from scoring to deal intelligence. It did not just summarize what the customer said. It interpreted the transcript and then pulled structured context from Salesforce and the telco product environment in CloudSense CPQ. From there, it could recommend a tailored package that fits both the customer’s history and the operator’s product reality. In the engagement, this included recommendations such as renewing an existing broadband plan at a higher speed with a competitive price, grounded in what the customer already has, what was discussed, and what the catalog supports.

This nuance matters. The recommendation engine was not about proposal generation or automated quoting. It was about shaping the deal: combining transcript insights, CRM history, and catalog reality to propose the most viable package and next best actions. Horizontal revenue intelligence platforms can highlight risks, themes, and coaching cues. They usually cannot connect those insights to telco product feasibility and structured opportunity moves.

Finally, the platform closed the loop by updating Salesforce after the call. It could create or update leads and opportunities, populate missing fields, attach the transcript and analysis, and update opportunity context based on what was discovered and sized. The outcome is that the CRM becomes more accurate because it is fed by structured evidence, not delayed rep notes.

Why ontology is the difference between “insight” and “execution”

The reason this works is not simply that we used AI. It is that we anchored the AI in a telco ontology.

Telco systems do not share a single definition of basic entities. Customer means one thing in CRM, another in billing, another in ordering. Product constructs differ between catalog, CPQ, and downstream fulfillment. Opportunity records in Salesforce often lack the telco-specific semantics that determine whether a deal is real, feasible, and properly sized.

BSS Magic’s Telco Ontology acts as the semantic layer that normalizes those entities and relationships so the AI can reason consistently. It is the bridge between what was said in a call and what must exist in structured form across CRM and product systems.

This is also where TM Forum standards matter. They provide the reference model for the entities and processes enterprise selling depends on, including lead and opportunity management. The ontology can ground itself in those standard constructs and then extend them with the operator’s specifics, which is what turns a general model into something executable inside a real telco environment.

In practical terms, ontology is what turns the platform from a smart listener into a smart operator. Without it, the AI can summarize. With it, the AI can map conversation signals to real telco objects like products, offers, eligibility constraints, and opportunity fields, and then safely take the next step inside Salesforce and the product environment.

What “done right” looks like in enterprise sales operations

This engagement validated a simple proposition: telco enterprise revenue intelligence needs to be built around telco semantics and telco execution paths, not generic sales analytics.

The customer expected full-coverage call analytics and QA, real-time extraction of requirements, automated CRM updates, improved coaching effectiveness, and better forecasting through deal sizing grounded in real product and pricing context.

A second-order outcome matters just as much: the platform is not a one-off tool. Because it is built on a customizable ontology-driven foundation, the customer saw a path to expanding the capability beyond call scoring into additional internal applications, including interest in building a custom CPQ and using the platform as an internal enablement layer for AI projects. That kind of expansion only happens when the foundation is semantic and reusable.

The takeaway

If you are a telco trying to apply revenue intelligence to enterprise sales, the goal should not be prettier call summaries. It should be faster and more reliable deal execution.

Horizontal platforms can help with visibility and coaching. What they cannot reliably do is connect conversations to telco product reality and then drive system actions across CRM and catalog environments. That gap is where deals slip, forecasts drift, and reps waste time.

A telco ontology closes that gap. It gives AI the context to understand what a requirement means in your world, map it to what you can actually sell, and translate it into structured updates that change outcomes.

That is telco enterprise revenue intelligence, done right.

Want to see BSS Magic solving your challenges? Book a demo today.

FAQs

BSS Magic addresses the gap between call intelligence and deal execution in telco enterprise sales. It doesn’t just analyze what was said-it understands what it means in telco terms. By using a telco ontology as a semantic layer, BSS Magic connects sales calls to CRM data, CPQ rules, and product catalogs. This allows it to recommend viable packages, update Salesforce records automatically, and coach reps consistently against the operator’s playbook. The result is faster deal progression, more accurate opportunity data, and reduced manual effort for sales teams, without replacing existing systems.

Telco ontology provides a shared semantic layer that normalizes entities like customer, product, offer, and opportunity across CRM, CPQ, and catalog systems. In most telcos, these entities mean different things in different systems, which prevents AI from acting reliably. The ontology bridges that gap by grounding AI reasoning in telco-specific definitions and relationships. This allows the system to map conversation signals – such as upgrade intent or pricing sensitivity – into structured actions like opportunity updates or package recommendations. Without ontology, AI can summarize; with ontology, it can execute safely inside enterprise sales workflows.

Horizontal platforms like Gong or Clari are designed for cross-industryB2B sales and stop at recognition and summarization. They can identify themes such as “pricing” or “renewal,” but they lack the telco-specific context needed to interpret those discussions into real product constructs. Telco enterprise deals involve bundles, eligibility rules, speed tiers, promotions, margin constraints, and downstream feasibility. Without deep integration into CPQ, catalog, and CRM semantics, horizontal tools leave the hardest and most expensive work to humans. As a result, insights don’t translate into faster deal execution or improved outcomes, which is where telco sales teams feel the real pain.

Yes. BSS Magic is designed as an overlay, not a replacement. In the example described, it integrated with Salesforce for CRM, Webex for call capture, and CloudSense for CPQ. The telco ontology abstracts differences between systems, allowing AI to reason consistently without brittle point integrations. This means operators can augment their existing sales stack rather than rip and replace it. Integration is faster and more sustainable because logic lives in the semantic layer, not in custom code or vendor-specific workflows.

Thanks to the ontology-driven foundation, the described enterprise sales intelligence solution was delivered in just four weeks from concept to deployment. This included call ingestion, CRM integration, CPQ alignment, deal recommendations, and coaching logic. Traditional approaches would require months of customization and data modeling. By reusing telco semantics and patterns embedded in BSS Magic, a single Forward Deployed Engineer (FDE) was able to deliver production value rapidly, demonstrating how ontology dramatically reduces time to value for AI initiatives in telco sales.

Sales managers struggle to listen to enough calls to coach consistently. BSS Magic automates this by scoring every call against the operator’s own QA and training criteria, not generic sales metrics. It evaluates behaviors like qualification quality, product knowledge, and communication effectiveness, using evidence from real calls. This produces consistent, data-backed coaching signals across the entire sales organization. Managers can focus on targeted improvement rather than anecdotal feedback, improving rep performance while reducing the overhead of manual call reviews.

No. Enterprise sales is a high-impact starting point, but the same ontology-driven foundation can be reused across other domains. Customers in the engagement saw a path to expanding into custom CPQ, internal enablement tools, and broader AI-driven BSS use cases. Once telco semantics are normalized, AI capabilities become reusable building blocks rather than one-off projects, significantly increasing ROI across the organization.